It’s 2026, and you’re staring at a $12,000 monthly bill for a drug that keeps you alive - but makes you nauseous, tired, and sometimes so weak you can’t hold your grandchild. Your doctor says it’s the best option. Your insurance says it’s covered. But your bank account says no. This isn’t a hypothetical. Thousands of people in the U.S. face this choice every day. And the question isn’t just cost - it’s whether the benefit is real enough to justify the pain, the price, and the risk.

Why Do Some Drugs Cost More Than a Car?

The average new cancer drug in 2024 costs over $150,000 a year. Some gene therapies run half a million dollars per dose. You might wonder: how is this possible? The answer isn’t just research and development. It’s market structure. In the U.S., drugmakers set prices with little oversight. Unlike in the UK or Germany, where agencies like NICE or IQWiG evaluate whether a drug’s benefits justify its cost, the U.S. has no binding price controls. That means a drug can be priced at $500,000 - even if it only extends life by three months. But here’s what most people miss: the price isn’t what you pay. The list price - the sticker price - is often inflated. Manufacturers give huge rebates to insurers and pharmacy benefit managers, so the net cost is lower. But patients still pay based on the list price, especially in Medicare Part D’s coverage gap - the infamous “donut hole.” A drug listed at $12,000 a month might cost the patient $5,000 out of pocket, even after insurance kicks in. That’s not a discount. That’s a trap.When Do Side Effects Become Acceptable?

Side effects aren’t just a footnote. They’re part of the decision. Take CAR-T therapy for advanced leukemia. It costs $475,000. It requires hospitalization. Patients often get cytokine release syndrome - a dangerous immune overreaction that can cause high fever, low blood pressure, and organ failure. But for people who’ve run out of chemo options, it’s the only shot at remission. A 2023 ASCO patient survey found 78% of those who received CAR-T called it “worth the cost,” even with the side effects. Why? Because they went from terminal to alive. Compare that to a new $10,000-a-month biologic for psoriasis. It reduces skin plaques by 90%. But it increases risk of serious infections. And there are cheaper, safer alternatives - like methotrexate - that work for most people. So why prescribe the expensive one? Only if the patient didn’t respond to anything else. That’s the rule: expensive drugs aren’t first-line. They’re last-resort.The Real Measure: Quality-Adjusted Life Years

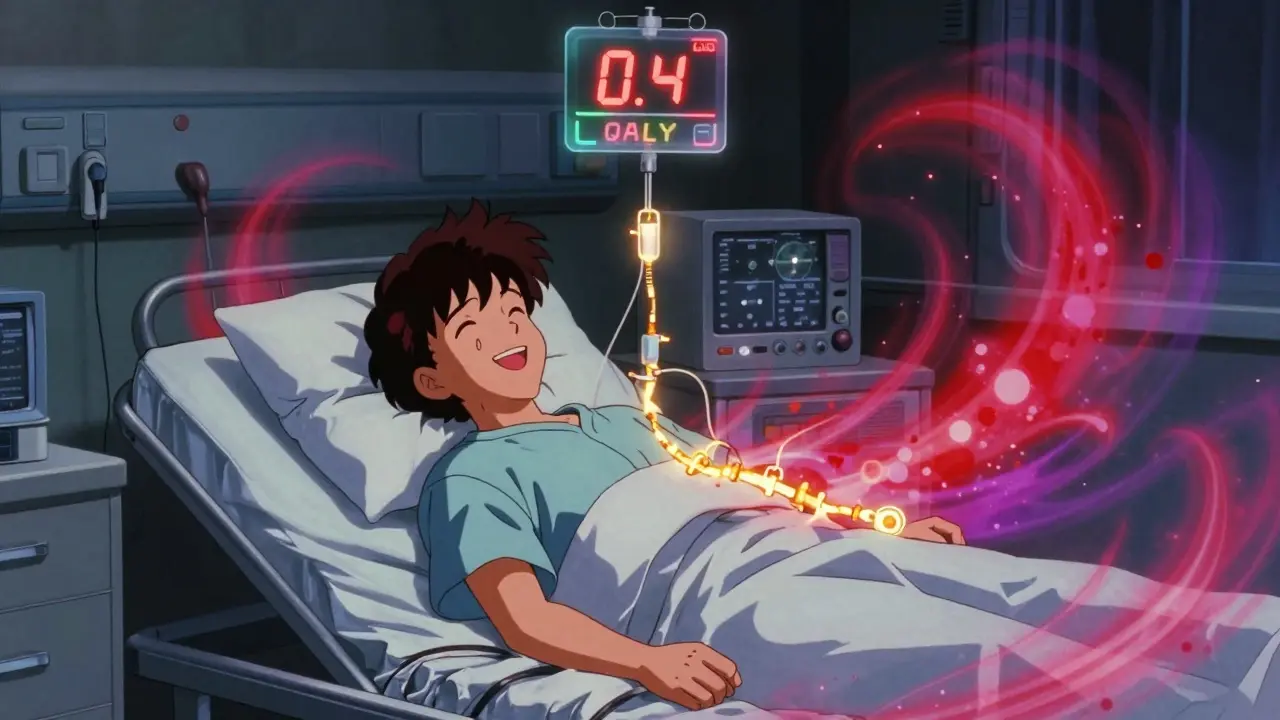

Doctors don’t just count how long you live. They count how well you live. That’s called a QALY - quality-adjusted life year. One QALY equals one year of perfect health. If a drug extends life by two years, but you’re bedridden the whole time, it might only add 0.4 QALYs. The UK’s NICE uses a threshold of £20,000-£30,000 per QALY. If a drug costs more than that per unit of health gained, it usually gets rejected. The U.S. doesn’t have a formal limit, but insurers and hospitals often use $150,000 per QALY as a soft ceiling. A 2024 NIH study looked at the 50 most expensive drugs. Over half were rated as having low or no additional benefit over existing treatments. That doesn’t mean they don’t work. It means they don’t work much better. For example, a new $12,000/month drug for multiple sclerosis might reduce relapses by 10% compared to a $3,000/month drug. Is that worth nine times the cost? For some, yes - if the side effects of the cheaper drug are unbearable. For others, no.

Who Pays the Price - and Who Gets Left Behind?

Medicare Part D beneficiaries without low-income subsidies spent 2.5 times more out of pocket on ultra-expensive drugs than privately insured people in the same age group. In 2023, 68% of patients taking drugs over $10,000 a month skipped doses to save money. 42% chose between medicine and food. This isn’t just financial stress. It’s survival math. But here’s the twist: the people who can afford these drugs often don’t need them. The most expensive drugs are mostly used for rare diseases - orphan drugs - which affect fewer than 200,000 people in the U.S. But they make up 72% of the top 50 most expensive drugs. Why? Because the Orphan Drug Act gives companies 7 years of market exclusivity and tax breaks. That’s meant to encourage innovation. But it’s also created a loophole: companies can price drugs for small populations at astronomical levels because there’s no competition. Meanwhile, common conditions like diabetes, high blood pressure, and depression have cheaper, effective drugs - but even those are becoming unaffordable for many. The problem isn’t just the ultra-expensive ones. It’s the system that lets them exist.When It Actually Makes Sense

There are times when the cost isn’t just justified - it’s life-saving. Take hepatitis C. In 2016, Harvoni cost $7,153 a month. But it cured 95% of patients in 12 weeks. Before that, the standard treatment was interferon - weekly injections for a year, with side effects like depression, fever, and fatigue. Cure rates? Around 50%. Harvoni didn’t just work better. It eliminated years of suffering. Even at that price, it saved money long-term - no more liver transplants, no more hospitalizations. The cost-benefit wasn’t just clinical. It was economic. Another example: emicizumab for hemophilia. Before this drug, patients needed IV infusions twice a week to prevent bleeding. Many still bled internally, damaging joints. Emicizumab is a once-weekly shot. It cuts bleeding episodes by 90%. It costs $15,000 a month. But it prevents joint replacements, emergency room visits, and lifelong disability. For a 25-year-old, that’s 50 years of better mobility. The cost? High. The benefit? Life-changing.

How to Navigate the System - If You Can

If you’re prescribed an expensive drug, you’re not alone. But you’re also not powerless. First, ask: Is this really the first option? Many insurers require “step therapy” - you have to try cheaper drugs first. Fight that if your doctor says it won’t work for you. Second, check for patient assistance programs. Drug manufacturers offer them for 40% of patients on average. You might get the drug for free or at a steep discount. Foundations like the Chronic Disease Fund give out over $2 billion a year in aid. Third, talk to your pharmacy. Specialty pharmacies often have case managers who spend hours on the phone with insurers. They know how to appeal denials, find rebates, and get prior authorizations approved. Fourth, understand your insurance phases. Medicare Part D has four stages: deductible, initial coverage, coverage gap, and catastrophic. You pay more in the gap - even if your drug is “covered.” The Inflation Reduction Act capped out-of-pocket costs at $2,000 a year starting in 2025. That’s a big change. But until then, know your numbers.The Bigger Picture: Is This System Sustainable?

The U.S. spends more on prescription drugs than any other country - $621 billion in 2022. Specialty drugs, which make up just 3% of prescriptions, account for 54% of spending. By 2030, they’ll be 79% of pharmacy costs. That’s not just expensive. It’s unsustainable. The 2022 Inflation Reduction Act tried to fix this by letting Medicare negotiate prices for 10 high-cost drugs starting in 2026. But 96% of the most expensive drugs are excluded because they’re too new, too rare, or too complex. The system is still broken. But here’s what’s changing: patients are demanding transparency. Doctors are pushing back. Independent groups like ICER and Prescrire are rating drugs based on real value - not marketing. And in 2024, for the first time, Medicare started negotiating prices. The results will be watched closely.Final Thought: It’s Not About the Price. It’s About the Trade-Off.

No one wakes up wanting to pay $10,000 a month for medicine. But when the alternative is death, disability, or decades of pain - the math changes. The question isn’t whether the drug is expensive. It’s whether the benefit is worth the cost to you. If you’re on a drug that makes you sick but keeps you alive - and you’ve tried everything else - then yes, it makes sense. If you’re on a drug that barely improves your condition but drains your savings - then it’s time to ask: is there another way? The system isn’t fair. But your voice is. Ask questions. Demand alternatives. Use the help that’s out there. And never assume the most expensive option is the best one - unless the evidence says it truly is.Are expensive medications always better than cheaper ones?

No. Many expensive drugs offer only marginal improvements over cheaper alternatives. A 2023 Prescrire review found only 7 out of 100 new drugs provided major therapeutic progress. Expensive doesn’t mean more effective - it often means newer, patented, or targeted to small patient groups. Always ask your doctor: "Is this significantly better than what’s already available?"

How can I reduce the cost of an expensive medication?

Start with your pharmacy - they often have access to manufacturer patient assistance programs, which can cover up to 40% of your out-of-pocket cost. Also check nonprofit foundations like the Chronic Disease Fund or Patient Access Network (PAN) Foundation. Some states offer additional aid programs. Always ask for a financial counselor at your treatment center - they specialize in navigating these options.

Why do some drugs cost so much if they’re not much better?

Drug prices are set by manufacturers, not based on value. The U.S. lacks price controls, and companies can charge what the market will bear - especially for orphan drugs with no competitors. Some drugs are priced high to recoup R&D costs, but studies show many new drugs cost far less to develop than claimed. The real driver is profit potential, not medical need.

What should I do if my insurance denies coverage for a needed expensive drug?

Denials are common - but they can be appealed. Your doctor must submit a letter of medical necessity, and your pharmacy can help with paperwork. Most insurers have a formal appeals process, often with a second review by an independent medical reviewer. Don’t give up after the first denial. About 40% of appeals are successful. Also ask about temporary access programs - some manufacturers offer free samples while you appeal.

Are there any new laws helping people afford expensive drugs?

Yes. The 2022 Inflation Reduction Act caps out-of-pocket drug costs for Medicare Part D beneficiaries at $2,000 per year starting in 2025. It also allows Medicare to negotiate prices for 10 high-cost drugs beginning in 2026. But these changes apply only to Medicare, not private insurance. And 96% of the most expensive drugs are currently excluded from negotiation. Still, it’s the first major step toward price accountability in decades.

Can side effects make an expensive drug not worth it?

Absolutely. A drug that extends life by six months but causes constant nausea, nerve damage, or depression may reduce quality of life more than it improves it. That’s why tools like QALY (quality-adjusted life year) exist - to measure both length and quality of life. If side effects leave you unable to work, care for loved ones, or enjoy daily life, the trade-off may not be worth it - even if the drug works clinically.

Comments (8)

chandra tan January 10 2026

Man, I read this and thought of my uncle in Delhi who pays out of pocket for his diabetes meds because insurance here doesn't cover the good stuff. Same damn problem, different continent. You think $12k/month is wild? Here, people split pills just to make it last. No one talks about this outside the U.S., but we feel it too - just quieter.

Faith Edwards January 12 2026

One cannot help but observe the profound moral dissonance inherent in a system that commodifies human survival with the callous indifference of a Wall Street arbitrageur. The pharmaceutical industry, having been granted quasi-monopolistic privilege under the guise of innovation, now peddles life itself as a luxury good - a grotesque inversion of the Hippocratic Oath. One must ask: when did compassion become a liability, and profit, the sole metric of value?

Jay Amparo January 13 2026

I’ve been there. My sister got CAR-T last year. She was bedridden for weeks, had fever spikes that scared us half to death - but she’s alive. And she’s playing with her nephews again. That’s not just a treatment. That’s a second chance. I know the price is insane, but when you’ve seen someone fade away, you don’t care about the number on the bill anymore. You care about the laugh you hear at breakfast. That’s the real ROI.

Lisa Cozad January 15 2026

My mom’s on a $9k/month drug for MS. We used every patient program, negotiated with the pharmacy, even got a grant from PAN Foundation. It’s not easy, but it’s possible. Don’t give up. Ask for help. There are people who want to help - you just have to keep knocking on doors. And yeah, the system’s broken - but we’re still here, fighting for each other.

Saumya Roy Chaudhuri January 17 2026

Let me tell you something - you people act like $12,000 is a lot. In 2020, I paid $18,000 for a drug that didn’t even work. That’s why you need clinical trial data, not anecdotes. QALYs aren’t just numbers - they’re the only ethical way to measure this. And if you think the U.S. is the only country with problems, you’re delusional. India’s drug pricing is a mess too - but at least we don’t pretend our system is fair.

Mario Bros January 17 2026

Bro, I’ve been on that $15k/month hemophilia shot. It’s a game-changer. No more ER trips. No more joint pain. I can play with my kid now. Yeah, it’s crazy expensive - but so is a lifetime of wheelchairs. Don’t let the price tag blind you. If it lets you live - not just survive - it’s worth it. And if you’re struggling, DM me. I’ll send you the link to the patient program. You ain’t alone.

Christine Milne January 18 2026

It is patently absurd to suggest that any nation should permit the commercialization of life-saving therapeutics without stringent regulatory oversight. The United States, in its unbridled capitalism, has become the global laughingstock of pharmaceutical exploitation. The notion that a drug may be priced at $500,000 because it treats a disease affecting 17,000 individuals is not innovation - it is predatory. The moral bankruptcy of this system is staggering.

Bradford Beardall January 19 2026

Just read the part about hepatitis C. Harvoni was $7k/month - but it cured people in 12 weeks. Before that, interferon treatment took a year and had a 50% success rate. So even if Harvoni cost $84k a year, it saved $200k in hospital bills, transplants, lost wages. That’s not greed - that’s economics. The problem isn’t the price. It’s that we don’t calculate the full cost of *not* treating. We pay in suffering, not just dollars.